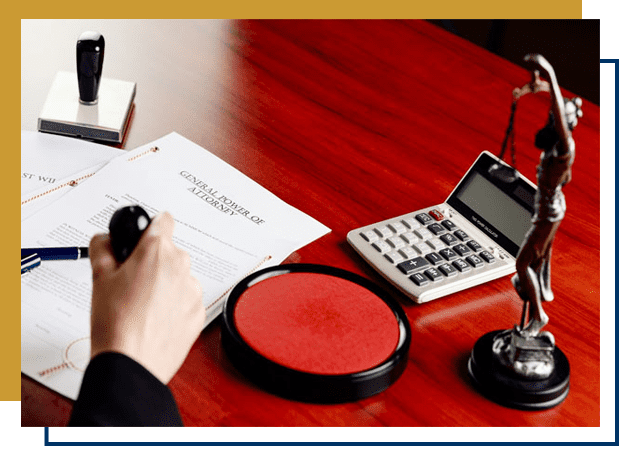

Power of Attorney

Write a durable power of attorney with the help of a professional estate planning lawyer.

Whether you’re already planning for your retirement or just starting out in your career, it’s never too late or early to plan how you want your legal, financial, and healthcare affairs to be managed in case something happens and you become unable to make major decisions and exercise control over important matters.

One of the best solutions is to grant power of attorney to your spouse, adult child, sibling, or close friend—or another person you trust to put your best interests at heart. This agent, also called the attorney-in-fact, is legally allowed to act on your behalf and make the decisions you would make if you were able.

At Myrthil’s Law, P. A., we can help you prepare for your future in the event that you become incapacitated and unable to make important decisions for yourself. There are different types of power of attorney you can grant someone, and we will help you choose which one of them best fits your needs.

Who Needs a Power of Attorney?

If you’re a legal adult, it’s a wise move to consider granting power of attorney to a family member or someone you trust. The type you choose should depend on various factors, such as your age, future life goals, and mindset.

- If you're a college student, you might want to consider a healthcare power of attorney to ensure that your family knows what treatment options you want in the event that you fall ill or encounter an accident.

- If you're a business owner, you might want to consider getting a special power of attorney to let other people handle business transactions, manage real estate, or sell properties on your behalf.

- If you're a new parent, you might want to consider a durable power of attorney to step in and make decisions for your family in case something unexpected happens.

- If you're newly diagnosed, you might want to consider a healthcare power of attorney. It will be one less thing to think about as you undergo treatment and navigate your way to full recovery.

Various Levels of Power of Attorney

What Happens if Someone Lacks a Power of Attorney?

Getting a power of attorney is not just a reassurance. It may serve as an estate planning tool that protects your health and legal and financial interests—and even your manner of dying. If you become unable to make important decisions and don’t have a power of attorney, your family might be forced into time-consuming and costly delays.

In Florida, if someone’s no longer able to manage their affairs, the court would have to appoint a conservator or guardian. Neither the person nor their family would have any control over the appointee. This process can be more difficult, more costly, and more public for every family to go through, so it’s best to plan and prepare ahead of time.

How Myrthil's Law,

P. A. Can Help

Myrthil’s Law, P.A. can help you navigate the often-complicated legality of establishing a power of attorney. Since there are various levels of power of attorney you can provide to someone else, it is key for you to choose the most appropriate type to fit your specific needs and future goals.

All situations differ for every individual, hence why an estate planning attorney can play a vital role in taking much of the stress from the matter. We will provide you with assistance in evaluating potential designees and tune in to your specific needs before creating a legal document drafted and supported by Florida statutes.